For many economists, the Leading Indicator is one of the most important for determining inflection points in the economy — both highlighting economic peak and trough periods. Inversions, especially from extreme levels, tend to portend a coming counter-trend from the preceding period.

The US News Index compares favorably to the US Leading Indicator in that it tends to invert from rather extreme levels around the same time. An inversion from a peak implies a coming deteriorating period, like a coming recession or bear market. A positive inversion from an extreme low, in contrast, infers that the likely poor current environment will give way to improving conditions, such as an economic expansion after a recession.

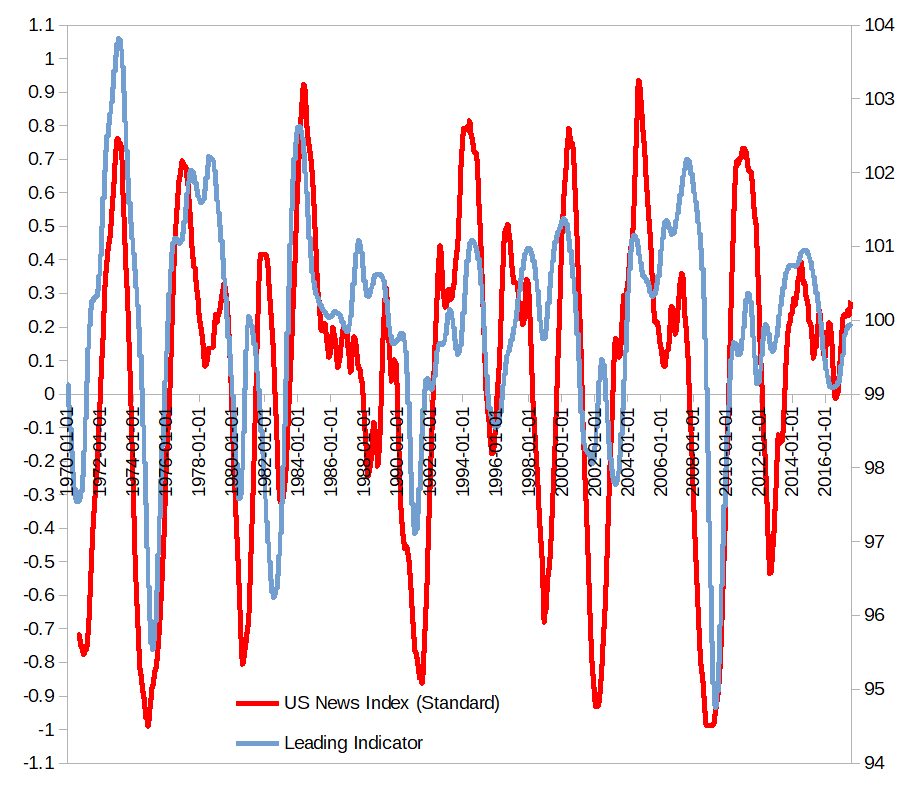

The following chart compares these two time series. The fact that they are so similar around important peaks and troughs tells us that one can be used to help in interpreting the other, which is one of the main points of using news analysis — it is not meant to replace established indicators but to help improve the overall understanding of the then-current environment.

Chart 1: US Leading Indicator and US News Index-Standard

The US Leading Indicator is pushed forward 2 months to take into account the delayed release of the data. This estimates when investors would actually have access to the data. In contrast, the news updates daily.

Generally, the two time series tend to invert around the same time periods. This is especially true around the troughs of the economic cycle and near the panic periods of financial crises.