A major advantage of using news as a forecasting tool is that it is updated in real-time, as compared to macro data like leading indicators which are usually monthly data with a delayed release. In this post, we provide a basic example of the advantage gained using real-time daily time series versus monthly delayed data.

As a side note, we should highlight that we are not arguing against using monthly macro data. In fact much of the discussion in these posts is for professionals to use news data to supplement other data such as macro data. More specifically, news-derived data, such as the news indices we present, can help to clarify other datasets and help to eliminate the ‘air-pocket’ left between the present and the last release of monthly macro data.

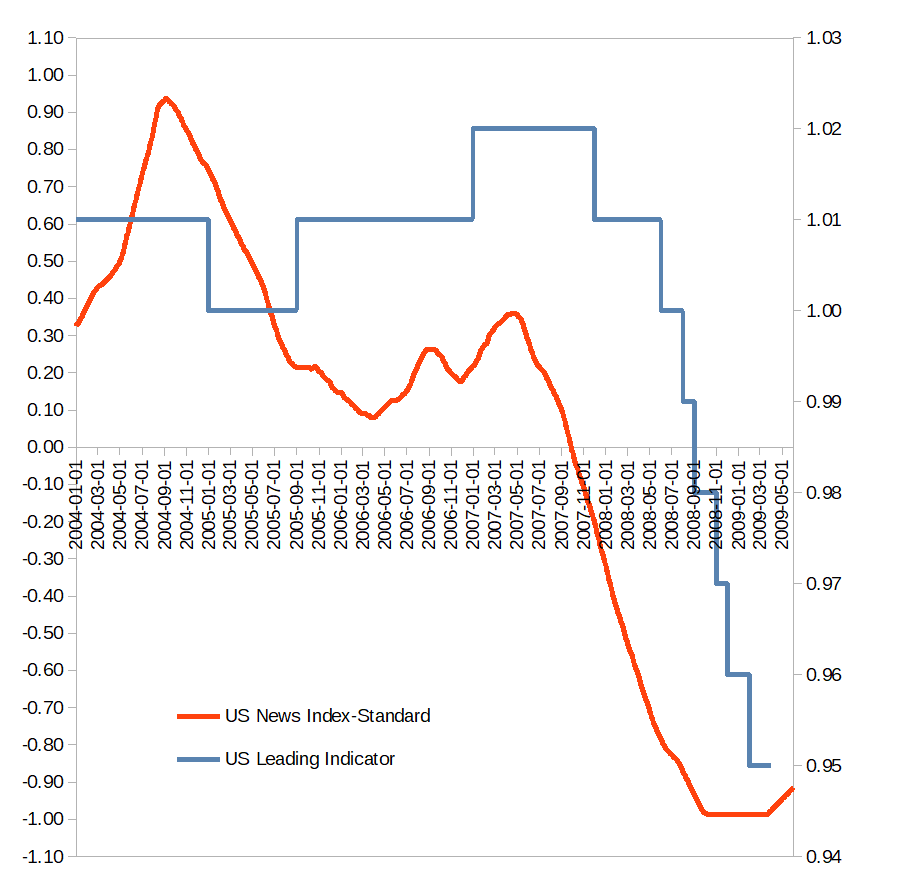

The following chart helps to highlight the downside of delayed data. The chart shows the US News Index-Standard versus the US Leading Indicator. The time period, 2004-2009, of the chart is likely one of the more volatile of the last few decades as it includes the run-up to and then the Great Recession.

Chart 1: US News Index-Standard compared to US Leading Indicator

The US Leading Indicator, when plotted on a daily chart, looks extremely clunky. Again, we are not saying not to use monthly data releases. The point is more to highlight the limitations of monthly macro-economic data. In contrast, the News Index updates daily and we can see a nice smooth time series.

Additionally, note at the end of the time series the Leading Indicator is not fully updated. This is an attempt to show how an investor at that time would have seen this data. With delayed data, investors are living in that unfortunate ‘air-pocket’. The New Index attempts to fill this gap – as seen in the chart it is updated further than the Leading Indicator. It might not seem like much, as the chart covers years of data, however that relatively small slice of time was just as the stock market had begun to bounce off of its bear market low. This would prove to be the low of the bear market, from which a major bull market would begin.

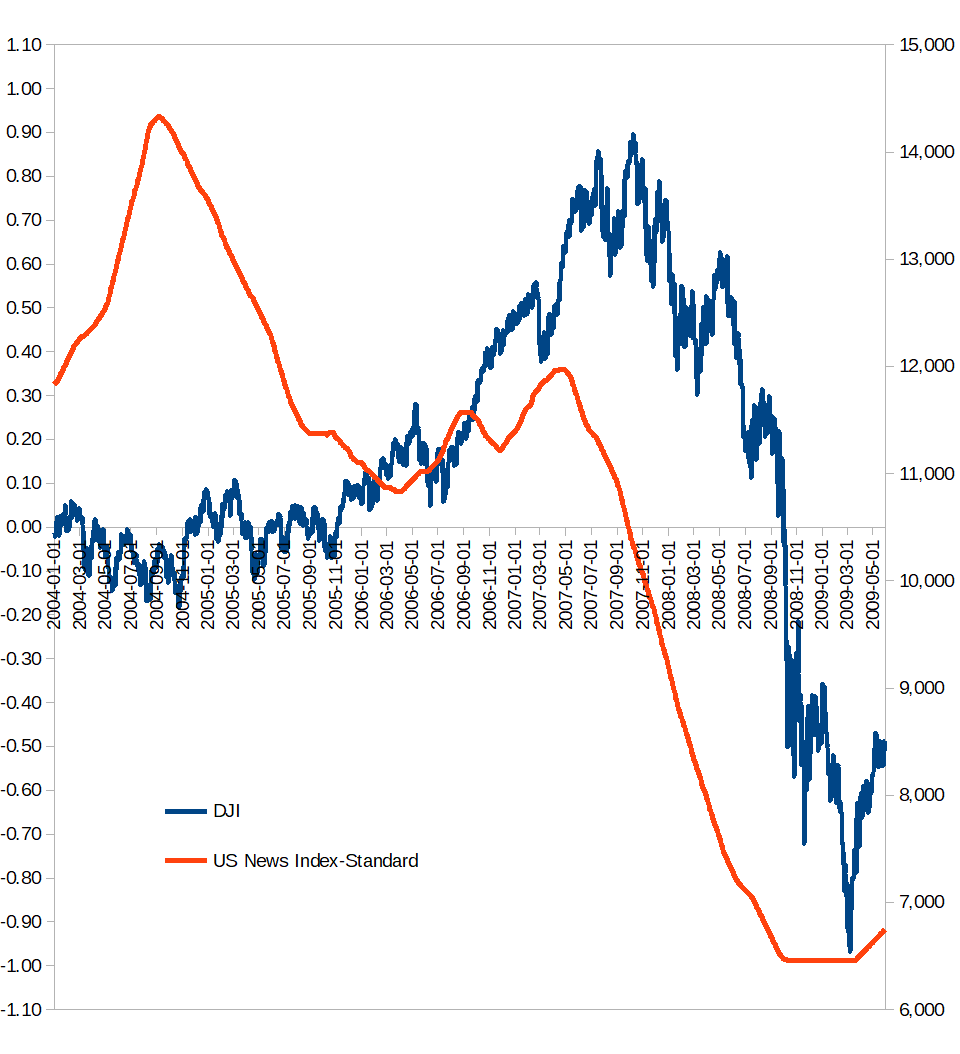

Chart 2: US News Index-Standard compared with Dow Jones Index

The 2009 low of the US News Index timed the stock market low almost to the day. This is an exceptional example of course and not all major bear market bottoms are timed so well by the news. In this particular case, you can see how having had the News Index updating daily would have proved extremely useful – especially in comparison to the delayed Leading Indicator.

Another interesting point occurred around the bull market peak in 2007. By the time the DJI had hit its peak, two important observations would have been noted. First, the US News Index had been declining rather rapidly for months prior to the equity market eventual high. A user at the time could have seen such a decline and been on guard. Second, the peak of the US News Index in 2007 was clearly divergent with the previous major peak in 2004. Such a negative divergence would have likely alerted users that the economic situation in 2007 was not as strong as many assumed at the time.

In contrast, the Leading Indicator around the 2007 equity market peak would have functioned more like a coincident or lagging indicator. Once you take into consideration that its monthly data is delayed, a user of this indicator would have received a rather late signal.