Summary

ZettaCap’s Medium-Term Sentiment Indicator (MT Sentiment) shows that the US equity market is in a risky state, where the reward to risk ratio is unfavorable.

MT Sentiment has been declining from an extremely high plateau, while price levels have remained firm. A diminishing economic growth outlook, together with the above factors, creates an environment over the coming 6 months or so where equity markets are vulnerable.

This does not necessarily mean that a sharp price decline will occur, only that the conditions are now present for this to happen.

The consensus view appears to be that economic growth expectations will soon improve, that sentiment will remain strong, and that there is little downside from current price levels.

ZettaCap’s MT Sentiment shows that the consensus could be misreading the assumed stability of sentiment which could open the door to an unexpected equity market decline.

Medium-Term Sentiment Indicator

Sentiment is one of the keys to understanding market movement. However, sentiment, today, is mostly used as a short-term trading trigger. In fact, it is likely most seen as a volatile line chart that looks more like a heart rate monitor graph than something attempting to measure how market participants view market conditions over time.

ZettaCap has developed the MT Sentiment indicator. Like many other indicators or models that ZettaCap uses, it is proprietary and innovative. So, please speak with an investment advisor concerning any investment decision and prior to taking any action.

How to Interpret

MT Sentiment was created with multi-month time forecasting windows in mind. It is not meant to be used for short-term (daily or weekly) trading. Its best use case is determining shifts in underlying market conditions based on extremes of market participant’s outlook. Some points to keep in mind:

- Revert to the Mean – eventually MT Sentiment reverts to a neutral level, this does not mean that it will revert over a certain time period which makes forecasting difficult, however if the indicator remains at an extreme level for an extended period, we should expect a reversion sooner rather than later,

- Neutral Line Reset – it seems that MT Sentiment resets itself by crossing the neutral line, once it does, the next major inversion should be watched closely as it likely indicates a price reversal is coming,

- Multi-Month Trends – once the indicator makes a major direction change, the prevailing trend seems to last for multiple months, making it an interesting indicator for position trading as opposed to using sentiment for day trading or short time windows,

- Divergence — an interesting set up occurs when equity prices diverge from MT Sentiment, such as when prices continue higher as MT Sentiment trends down.

MT Sentiment versus Nasdaq Index

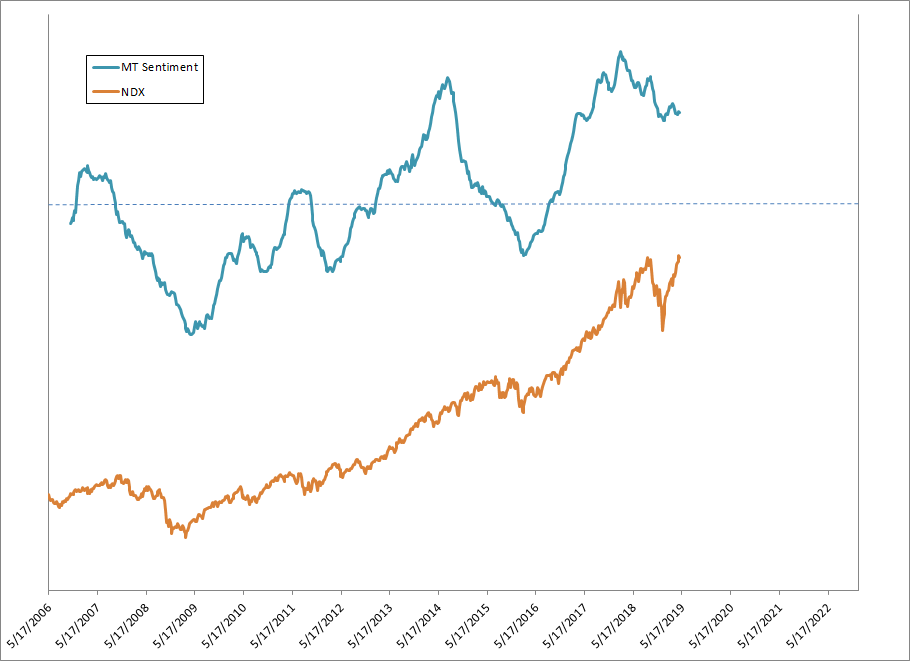

In practice, MT Sentiment produces a good fit with the broad equity index. Like every indicator, it is not perfect, but important inversions are shown to coincide or even precede trend inversions for the Nasdaq (NDX).

Exhibit 1: Medium-Term Sentiment Indicator and Nasdaq Equity Index, with a sentiment neutral line

Source: ZettaCap

Generally, MT Sentiment has done an exceptional job at providing early warning signals prior to major equity trend reversals. Especially in the case of market tops, this indicator seems to provide ample time to adjust equity positions.

For instance, MT Sentiment turned down from a high level in early 2007, months ahead of the eventual 2007 stock market peak. Obviously this was followed by a tremendous bear market.

Another major MT Sentiment top began in 2Q14 and continued for about the next year and a half. This downward trending MT Sentiment seemed to act like a drag on price appreciation, with the NDX generally moving sideways over that period while producing volatile and sharp declines into 2015.

Interestingly, when MT Sentiment turned up after these sell-offs, it seemed to signal a turning point for equity markets. You can see in the chart that after such positive inversions for MT Sentiment (after the equity sell-offs), the equity market performed extremely well during the following 12 to 24 months.

In other words, given the correct conditions which seems to include improving sentiment, equity markets tend to perform well. In contrast, a deteriorating MT Sentiment tends to indicate worsening market conditions where equity prices tend to struggle even during secular bull markets.

MT Sentiment Turns Down

MT Sentiment has been at an extremely high level since around the end of 2017. It then began to more steadily deteriorate from February 2018. Since that time it has been trending slowly downwards.

The current stage seems to resemble MT Sentiment in early-2007 and mid-2014. In both of these cases, MT Sentiment had decidedly turned down and had continued to trend lower while equity markets struggled higher, albeit with very marginal gains.

The current environment sees MT Sentiment trending down in the face of the equity market having had its best quarter in years.

This type of divergence between MT Sentiment and price action does not sit well.

Given previous examples of similar divergences, we do not believe the equity market has made its final low (the kind of low that the market can use to push to significant and sustainable new highs). It looks like we could see a difficult ‘sideways’ market which will likely entail retesting the 2018 low or perhaps even a sharp equity decline exceeding its 2018 low.

Again, judging from previous cycles, we expect market conditions to be able to sustain new highs only after the MT Sentiment has declined to around the neutral line and then reverts and trends up again – and that is far from happening.

In theory (and so far in practice), MT Sentiment will not remain at an extreme but eventually revert to a neutral level. Then, once it has done so, a new trend can begin.

MT Sentiment is due for a decline towards or past the neutral line. It has begun to trend in that direction but even if it continues on the same trend, it could take (perhaps) 6 months to discharge such excess optimism.

The current scenario seems to have two potential outcomes:

- MT Sentiment Remains Strong – assuming this indicator turns up and remains at a high level, around where it has been since mid-2017, it would indicate continued risk for the market, having MT Sentiment too high for too long implies a fully priced market which is not one that is attractive for longer term investors,

- MT Sentiment Declines in order to Reset – assuming this indicator continues to decline, we would expect it to reach or perhaps exceed the Neutral Line, after which an upturn in MT Sentiment would be an excellent signal that the equity market could sustain longer term appreciation, with MT Sentiment then trending upwards equity investors would have a strong wind to their backs.

Previous MT Sentiment ‘Signals’

MT Sentiment is not meant to be a trading system, but an indicator that measures market participants’ outlook which can be used to determine market extremes and important inflexion points. Having said that, looking at the timing of previous inversions is interesting.

Exhibit 2: Medium-Term Sentiment Indicator and Nasdaq Equity Index, with a sentiment neutral line and with highlighted inversion ‘signals’ in red and green

Source: ZettaCap

The red dots show downturns of MT Sentiment from elevated levels and green dots show upturns from depressed levels.

The first downturn occurred in February 2007, about 8 months prior to the Nasdaq peak, providing plenty of time to adjust portfolios before the massive bear market. The upturn occurred in April 2009, or about a month after the panic bear market low of equities.

The next two MT Sentiment downturns occurred during one of the largest bull markets in history. They were followed by a general pause in equity appreciation and increased price volatility.

The last MT Sentiment downturn occurred in February 2018 and since that time equity markets have been moving in a broad and volatile sideways movement. The Nasdaq has made marginal new highs but many international equities (such as emerging markets as well some developed markets like Japan and Germany) have struggled as have other US equity indexes (such as the NYSE which is a broader index). Additionally, other assets have crashed from that period such as crypto currencies, many of which made their all-time highs just a month before the MT Sentiment peak.

In short, since MT Sentiment’s last downturn in early 2018, some of the stronger markets have made marginal new highs but have not been able to sustain them whereas weaker markets and assets have struggled.

Economic Growth Outlook

Markets are not simply reliant on a single factor. There are always multiple factors hitting the market. Sentiment, however important, does not explain the whole picture. Though it is not possible to provide an entire overview of the market, we should briefly cover economic growth outlook as it has a reasonable possibility of acting as a trigger over the coming months to sap sentiment.

Equity markets tend to do better in economic expansions and tend to perform poorly during contractions. A grey area exists during marginal economic slowdowns, however. In such an environment, equity markets tend to decline but not always.

Markets, when assuming the slowdown will be brief and shallow, will mostly tread water. In essence, markets will bide time until the slowdown runs its course and economic activity re-accelerates. This is where markets are today with equity prices moving sideways over the last year to year and a half in the face of marginally slowing economic activity.

In contrast, if markets assume the initial economic slowdown will continue into a full-fledged recession or even a growth lull (not followed by another pickup, but something akin to stagnation), a sharp equity decline follows. Such a decline could take the form of an abrupt drop (like a multi-month mini-panic) or an extended bear market (like those from 2000-2003 and 2007-2009).

Alternatively, the next phase of the economy might not be as binary as it has in the past. With unemployment at generational low levels even as marginal growth indicators are off their peaks, we could be headed for risks still undetermined. In such a scenario, the trigger that shocks sentiment lower might be wage inflation.

Risk Zone

For about the next 6 months, we will be in an extremely risky period for US equity markets. It is not just MT Sentiment turning down from high levels but instead, it is a combination of factors as outlined.

Specifically, the market seems priced for a shallow economic slowdown (which would soon be followed by a re-acceleration) with sentiment remaining strong.

There does not appear to be much wiggle room incorporated in the current consensus scenario. In other words, if things do not go according to consensus (meaning a few unexpected negative factors impact the market) there does not appear to be much of a cushion.

A 6 month time window should be sufficient to determine if the consensus scenario will play out. Within this period, markets should be able to determine if the economy will follow its current consensus course or not.

If the scenario begins to shift towards one of increasing risk, the markets could correct quite sharply.

Further, even if the slowdown does in fact end up being shallow (the positive bullish scenario for equities), there could still be unforeseen complications. Speculative examples of such trigger events include US-China tensions increasing, US-Iran tensions increasing, Venezuela entering into an armed civil war, and political turmoil hitting new highs in the US.

These events might not be enough to produce a hard sell-off at other times, but given the assumption that the market has little cushion built-in, their impact would be amplified.

We cannot forecast exactly what will be the eventual trigger for such a sell-off only that in an environment of elevated equity prices, high yet declining MT Sentiment, and deteriorating economic activity, a sharp price decline is possible even with a limited push.

Worst Reward / Risk Payoff in a Decade

The environment outlined here makes the reward / risk ratio lopsidedly negative. The upside from current levels, at least over about the next 6 months looks minimal with the downside being substantial.

In fact, it looks like one of the worst reward / risk ratios since the 2009 equity market low.

During previous post-2009 economic slowdowns, MT Sentiment declined to below its neutral range. Such a decline showed that market participants had adjusted their outlook given contracting growth expectations and apparent increased risk. During the same periods, we saw the Nasdaq decline as well.

At present, at the risk of repeating one too many times, growth expectations have been declining but MT Sentiment and price have remained high. The market just looks too confident. And, an overly confident market does not look good going into such a large revelation concerning an expected economic upturn.

At this time, and this is an important point to highlight, we don’t even need a recession or overly disappointing conditions to materialize for the markets to decline. All we need is for conditions to prove themselves not quite as strong or positive as expected to shake MT Sentiment back to its neutral zone.

MT Sentiment Forecast / Equity Market Forecast

Forecasting sentiment is extremely difficult. However, because we are dealing with an indicator purposefully built for longer term conditions, we can make a reasonable attempt.

MT Sentiment will, over time, revert to its neutral setting. The problem of course is determining when that will exactly occur. Judging from current trends, the process of reverting back to or past the neutral level has already begun. This is a healthy normal occurrence. It is absolutely nothing to be concerned over by itself.

However, if the current trend continues for MT Sentiment, it will likely only turn up again once we have expelled the overconfidence. Again, this is normal – it is more or less how markets work in that you cannot expect sentiment to remain either excessively high or low.

Exhibit 3: : Medium-Term Sentiment Indicator and Nasdaq Equity Index, with a sentiment neutral line, with highlighted inversion ‘signals’ in red and green, and a base-case scenario forecast

Source: ZettaCap

This forecast is of course speculative as to timing and degree of decline.

However, the above forecast follows a common sense scenario in which sentiment returns to around a neutral setting at a pace comparable to previous declines. As longer term economic fundamentals appear strong in the US, we assume MT Sentiment will more or less bounce off the neutral area and strengthen once again.

Equity prices will likely decline in the face of sentiment significantly deteriorating.

The degree of the equity price decline is more speculative than the MT Sentiment decline. We can more directly pinpoint where the MT Sentiment will trend towards (neutral line) than we can equity prices.

A strong argument for an abrupt drop in equity prices is the current overconfidence given the somewhat deteriorating economic conditions.

In this speculative scenario, overconfidence could dissipate quickly. Sentiment going from consistently strong to neutral in a short few months could produce a pricing overshoot on the downside. Put bluntly, the conditions are now present for prices to abruptly fall with the slightest of nudges.

Speculative Scenario

We have to emphasize that this is a speculative scenario and that the main indicator used is proprietary. Further, you should be aware that using sentiment indicators to forecast multi-month trends is in itself unorthodox. Again, like all investment decisions, you should check with your investment advisor before making any decisions.